Xero

Due to the current legal deficiencies of the invoices generated by the OFN platform, it may be necessary to use the data included in reports as a source for external invoicing software.

Many food enterprises use the software package Xero for invoice generating and accounting. The reports available in the 'Xero Invoices' section enable you to easily download data in a form which is compatible with automatically uploading in bulk to Xero.

Xero is a totally independent software platform to OFN and hence screenshots depicted herein are demonstrative only.

Please contact Xero directly if you would like further advice on how to use their software.

This report creates CSV files which can be imported into the accounting package ‘Xero’ to generate invoices for customers. There are two options: a summary report and a detailed report; the latter includes a line item for each item the customer purchased, including any fees and adjustments to their order.

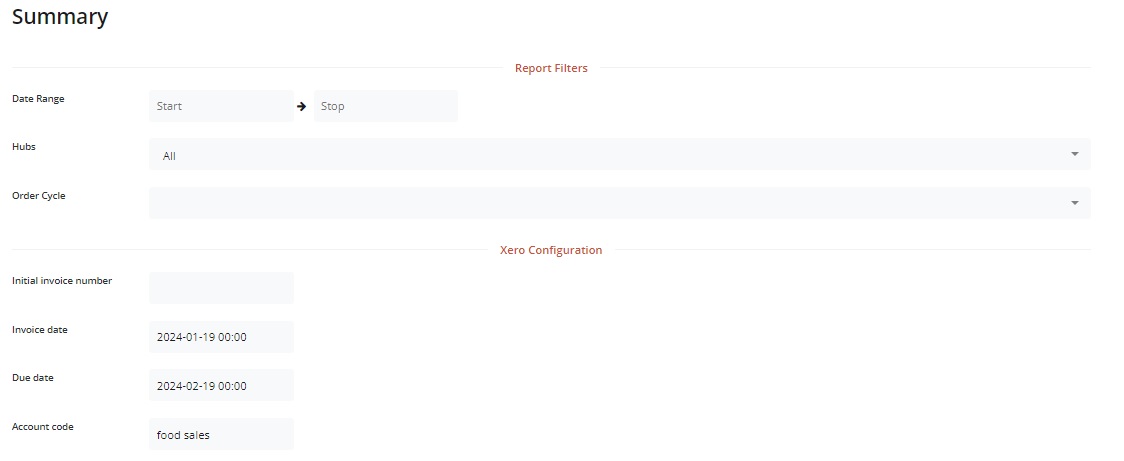

Date range: You can filter orders by the date the order was placed.

Hub and order cycle: You can specify which Hub and Order Cycle, the orders were placed through.

Initial invoice number: To ensure compatibility with your Xero invoice numbering system, enter the first invoice number you would like new invoices to be allocated. All subsequent invoices will be numbered from this point.

Invoice date: You can select the date that you want the invoices to be marked with in Xero. This is editable once you have the invoice in Xero, but doing it here allows you to batch date all the invoices in a single report.

Due date: You can select the due date to be marked on Xero invoices. Again this is editable in Xero.

Account code: If you place a Xero account code here, all items in the invoice will be assigned to this account. This it editable in Xero.

Rendering options: These are the same as other reports (on screen, PDF, Formatted or .csv; as well as choice of columns and specific data you wish to download)

Customer name, email, billing address (no phone number)

Invoice number and date of purchase. Due date is one month after invoice date. Reference number is the same as invoice number.

Product name, quantity, cost, tax rate, SKU, fee

Payment status (paid or balance due)

currency of transaction.

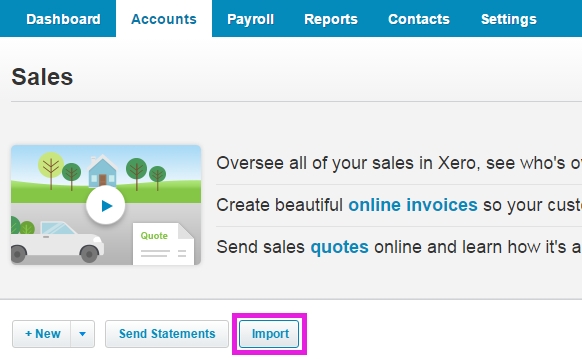

In Xero go to Accounts, Sales and click Import.

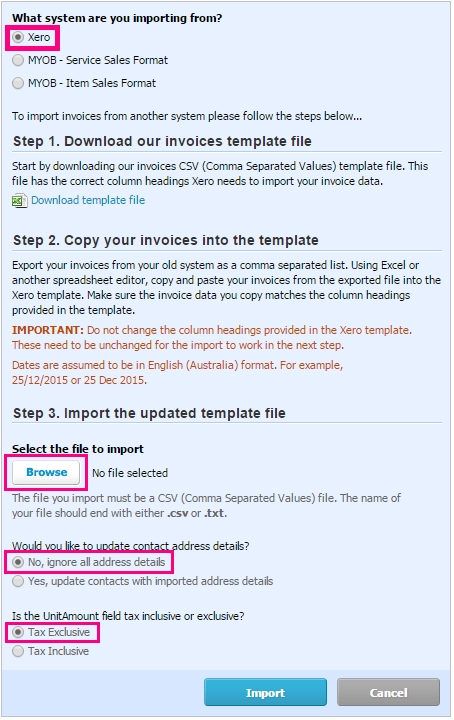

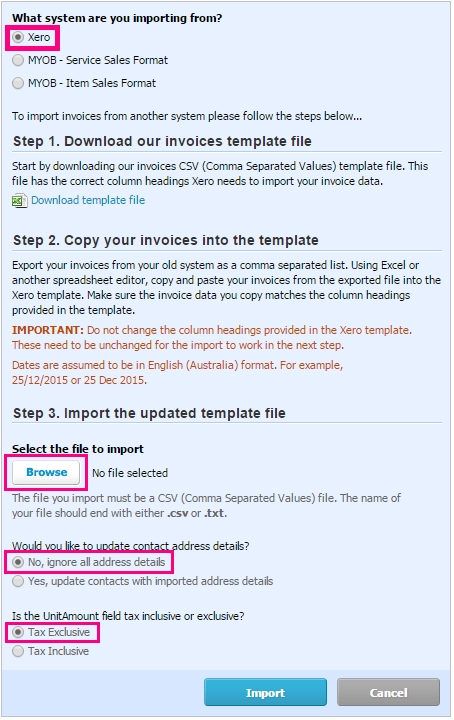

Next you will select your downloaded OFN Xero report for upload. The settings you should select are shown below.

Selecting Ignore contact address details will ensure your Xero customer data is unaltered.

Selecting Tax Exclusive will ensure that products you have set to include tax in the Open Food Network will include tax, but your tax free items will remain tax free.